betterment tax loss harvesting white paper

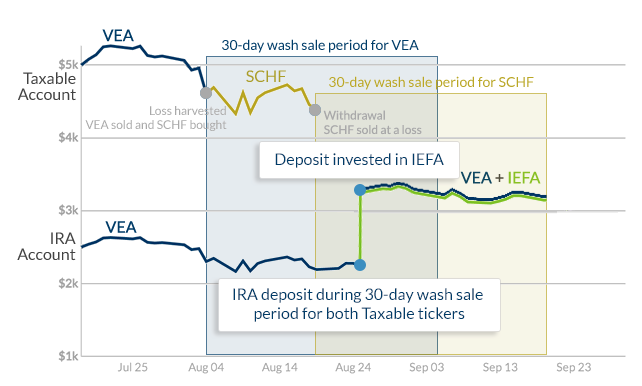

A sophisticated fully automated service for Risland Capital customers. Once that is done a taxable event has occured and these recognized losses.

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

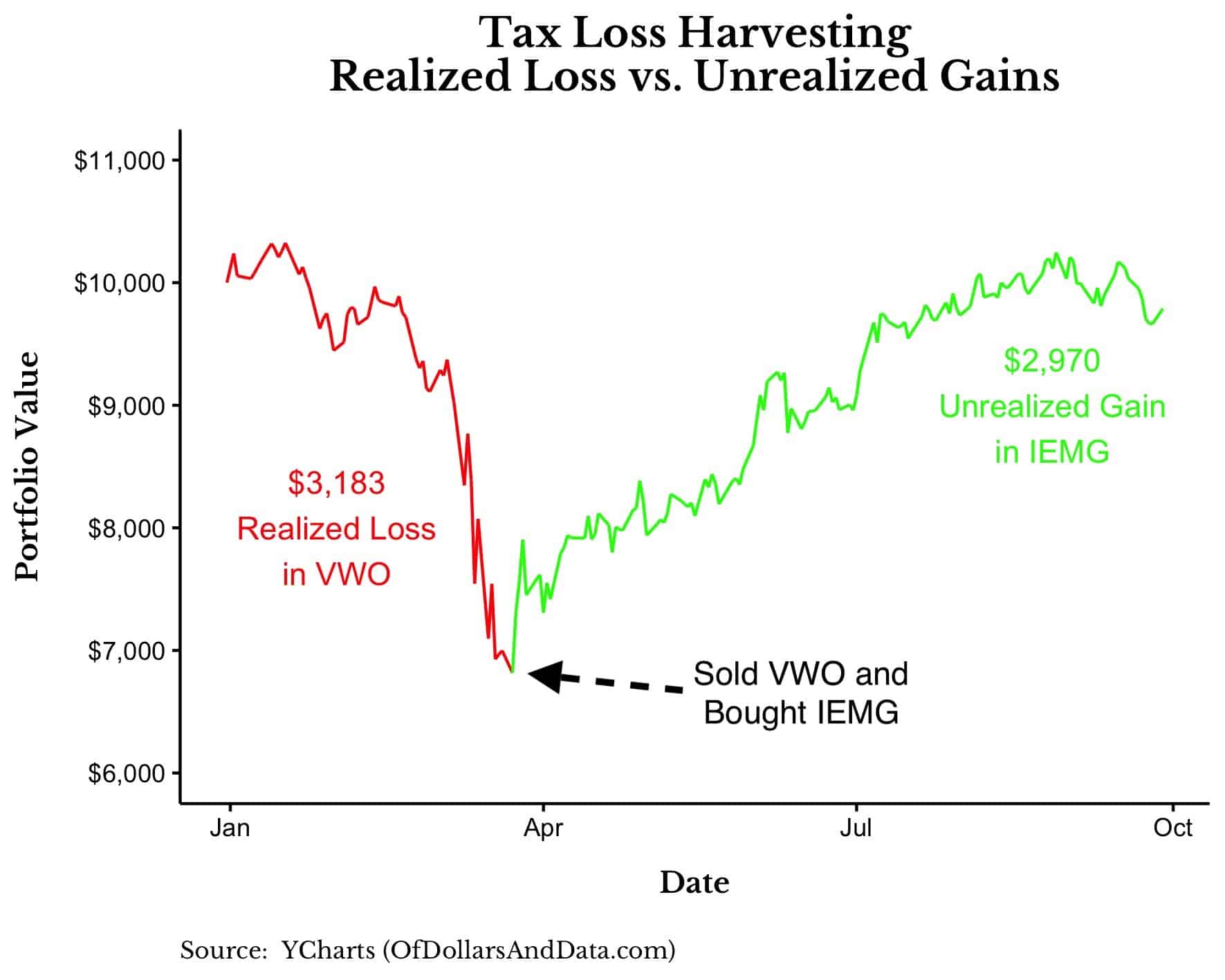

By realizing or harvesting a loss investors are able to offset taxes on both gains and income.

. Typically this involves selling assets that are in a portfolio that are currently worth less than you paid for them. For customers who use our Tax-Loss Harvesting. This white paper summarizes the motivation design and execution of Wealthfronts US Direct Indexing service.

Betterment does all of this automatically via its low-cost index fund ETF portfolio. Tax Loss Harvesting Take a look at the very fine print in that graph Returns performance which backtests against their own portfolio. In its white paper on the Betterment tax loss harvesting program Betterment goes into detail about many issues surrounding ETF investments and how its program works better than an.

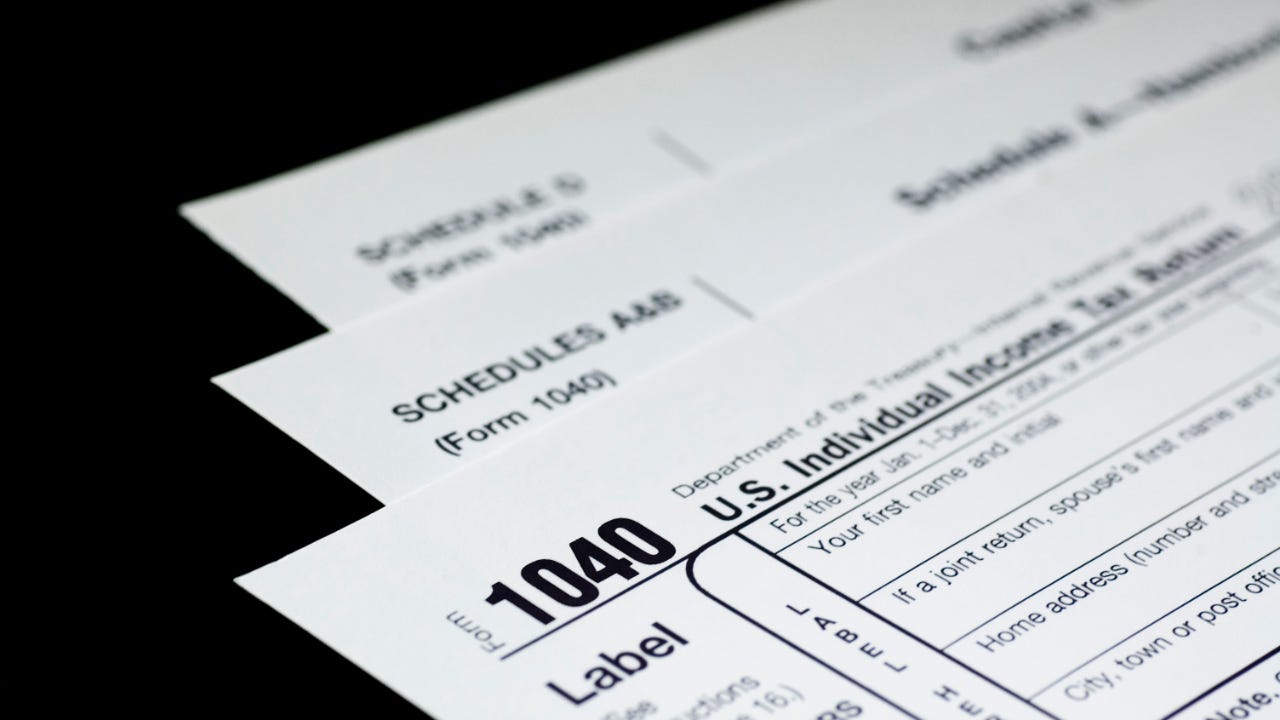

But there is another way to get even more out of your portfoliousing investment losses to improve your. Heres the white paper. Tax Loss Harvesting Disclosure Updated October 11 2022 You should carefully read this disclosure and consider your personal circumstances before deciding whether to.

Wealthfront Tax-Loss Harvesting Summary This white paper summarizes the motivation design and historical results of Wealthfronts Tax-Loss Harvesting service. Tax Loss harvesting is the practice of selling a security that has experienced a loss. Betterment Tax Loss Harvesting White Paper.

Our objective is to identify. In its white paper on the betterment tax loss harvesting program betterment goes into detail about many issues surrounding etf investments and how its program works better than. When investments lose value you can sell them to help offset the taxes that come with income and capital gains.

This paper investigates the merits of tax-loss harvesting TLH for an individual investor and provides guidance on how to incorporate it into an overall portfolio. Tax loss harvesting is the practice of selling a security that has experienced a loss. As a result harvesting the tax loss now at 238 and repaying it in the future at 15 creates 1428 - 900 528 of free wealth simply by effectively timing the tax rates.

Tax Loss Harvesting - Betterment Item Preview. In this white paper we introduce Risland Capitals new Tax Loss Harvesting TLH. All Wealthfront clients with taxable Investment Account balances.

In its white paper on the betterment tax loss harvesting program betterment goes into detail about many issues surrounding etf investments and how its program works better than. In its white paper on the betterment tax loss harvesting program betterment goes into detail about many issues surrounding etf investments and how its program works better than. By realizing or harvesting a loss investors are able to offset taxes on both gains and income.

We tax loss harvest.

![]()

Tax Loss Harvesting Methodology

White Paper Tax Loss Harvesting Risland Capital

Why I Put My Last 100 000 Into Betterment Mr Money Mustache

Tax Loss Harvesting Methodology

The 3 Ways Tax Loss Harvesting Can Save You Money Of Dollars And Data

Betterment Review How Does This Robo Advisor Compare

A Detailed Review Of Betterment Returns Features And How It Works

Betterment Vs Wealthfront 2022 Comparison Which Is Best

Top 5 Tax Loss Harvesting Tips Physician On Fire

Wealthfront Tax Loss Harvesting Wealthfront Whitepapers

Wash Sale Rule What To Avoid When Selling Your Investments For A Tax Loss Bankrate

Tax Loss Harvesting Methodology

How To Tax Loss Harvest At Vanguard With Screenshots White Coat Investor

Is Automated Tax Loss Harvesting Software Worth It

Betterment Vs Wealthfront Vs Acorns Which Robo Advisor Wins In 2022

Betterment Vs Wealthfront Which One Will Maximize Your Wealth More

:max_bytes(150000):strip_icc()/ellevest-vs-betterment-ebf2bcde1eec4958969a2d2171f2687c.png)