tax forgiveness credit pa schedule sp

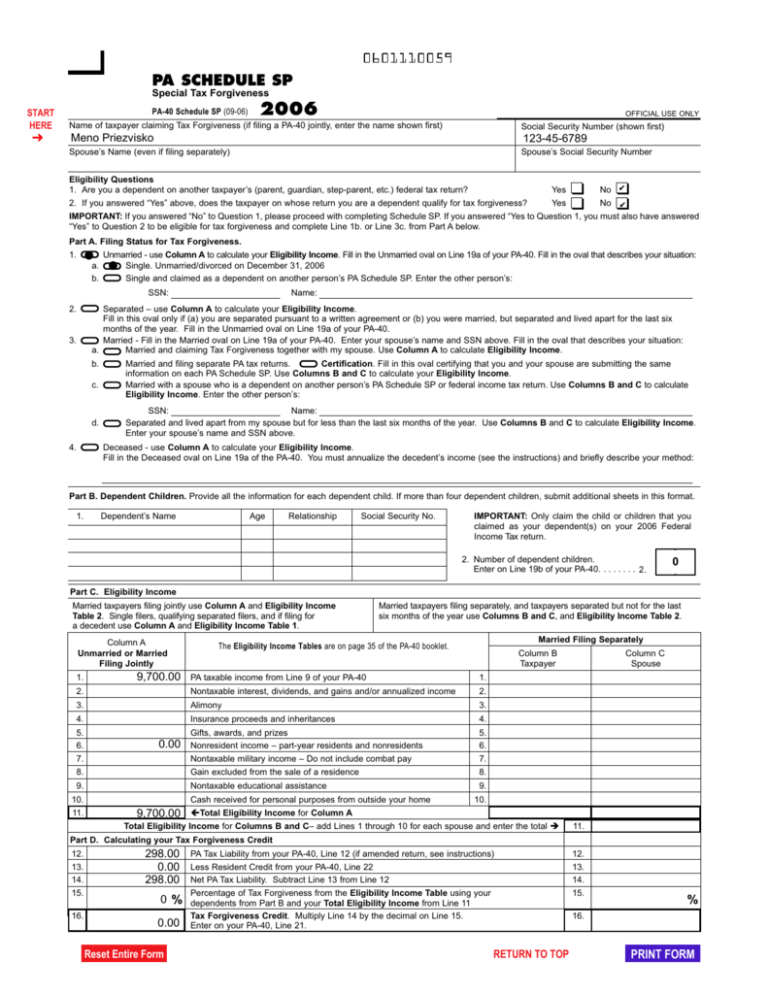

PA-40 Schedule SP must be completed. However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP.

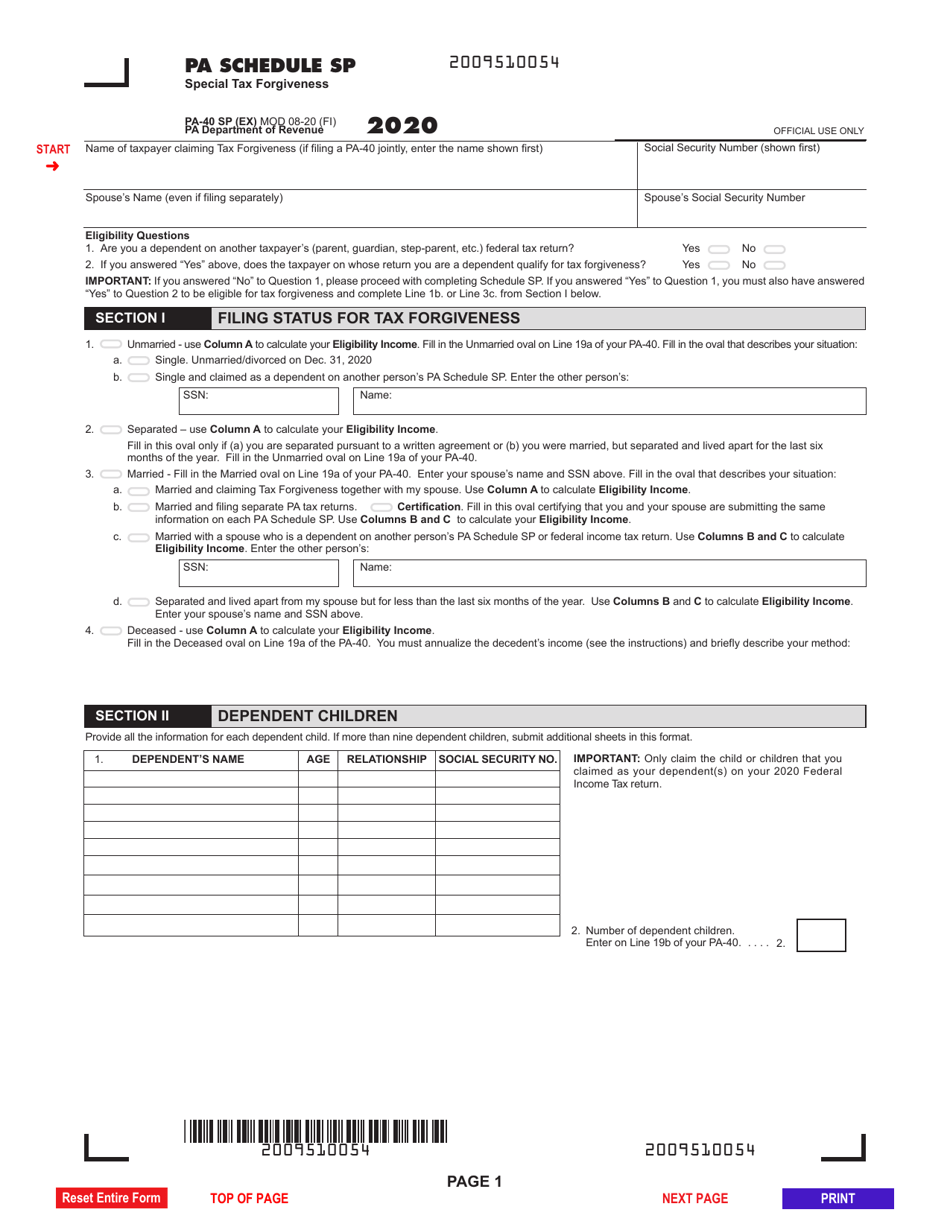

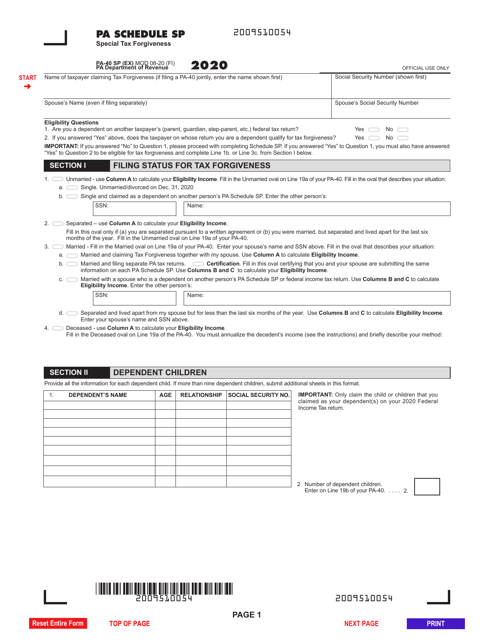

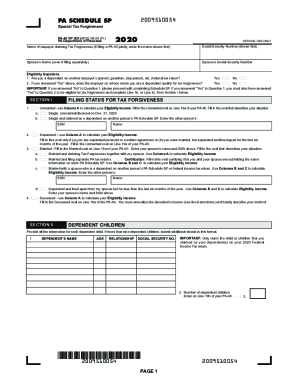

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

The amount of tax forgiveness is based on the taxpayers income and number of dependents.

. Use Get Form or simply click on the template preview to open it in the editor. On PA-40 Schedule SP the claimant or. On PA-40 Schedule SP the claimant or.

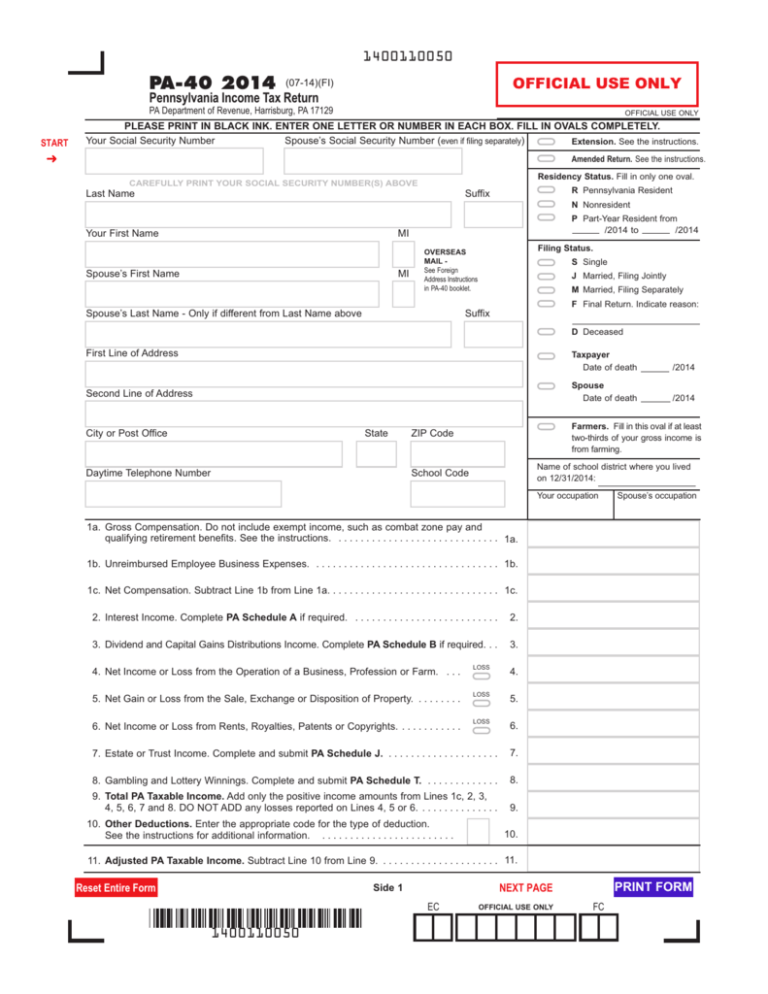

PA-40 Schedule SP must be completed and included with. More about the Pennsylvania Form PA-40 SP. To calculate your Eligibility Income.

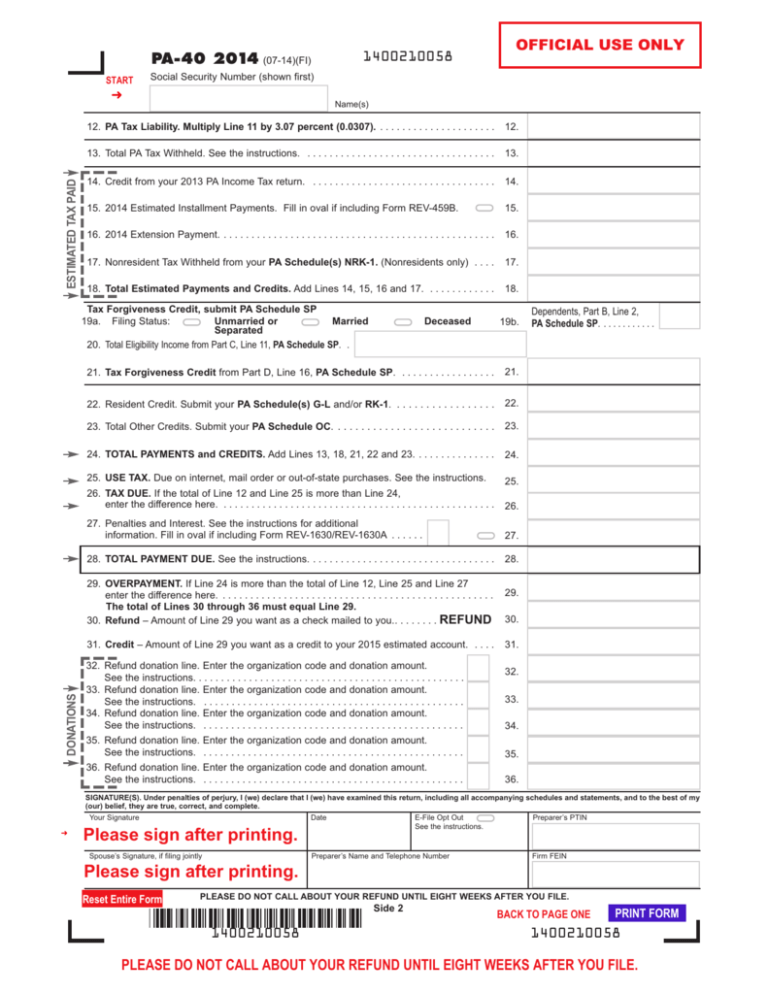

Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability. Calculating your tax forgiveness credit 12. To enter this credit within the program please follow the steps below.

We last updated Pennsylvania Form PA-40 SP in January 2022 from the Pennsylvania Department of Revenue. Taxpayers who qualify for PAs Tax. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability.

Special Tax Forgiveness. Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability. Schedule sp part c line 6 must be completed manually for a nonresident.

Tax Forgiveness is a credit that allows eligible taxpayers toreduce all or part of their PA tax liability. It looks like PA only considers earned income when qualifying people for this credit. Verifying your eligibility for Tax Forgiveness based on income tables and what forms to fill out if you qualify.

Insurance proceeds and inheritances- Include the total proceeds received from life or other insurance. Any taxpayers claiming the Tax Forgiveness Credit on Line 21 of the PA-40. First figure out your eligibility income by completing a PA-40 Schedule SP.

You are unmarried and your former spouse can. In the Eligibility Income section. PA SCHEDULE SP LINE 21 What is Tax Forgiveness.

However we also received 40k in Social. Unmarried - use. And included with an originally filed.

Pa schedule sp special tax. To claim tax forgiveness the claimant or claimants must complete and submit PA-40 Schedule SP with the PA-40 Individual Income Tax return. On PA-40 Schedule SP the claimant or claimants must.

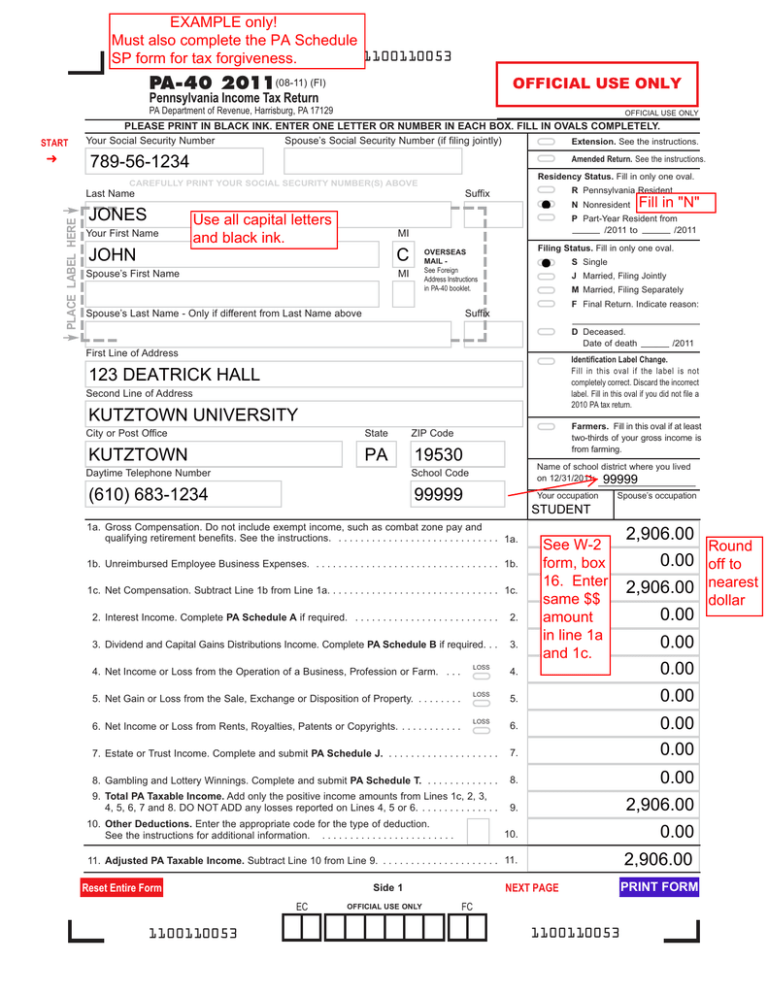

In this case the student must file hisher own tax return and PA Schedule SP. In the Tax Forgiveness Credit Schedule SP section enter data into the rest of the fields as needed. On PA-40 Schedule SP the claimant or claimants must.

3 rows PA Schedule SP Eligibility Income Tables. TurboTax indicates that we are eligible for the PA Special Tax Forgiveness Credit for 2021. Schedule SP Tax Forgiveness Credit What else do I need to know.

The instructions for filling out PA Schedule SP are included in PA-40 instructions available on the departments websitewwwrevenuepagovtaxforgiveness. If you are filing as Unmarried use Table 1. Start completing the fillable fields and carefully type in required.

To claim this credit it is necessary that a taxpayer file a PA-40 return and. Gives a state tax refund to. Part B is for taxpayers who have dependent children to claim for Tax Forgiveness.

If you do not have children. This form is for income earned in tax year 2021. A dependent child may be eligible if he or she is a dependent on the Pennsylvania Schedule SP of his or her parents grandparents or foster parents and they also qualify for tax forgiveness.

A 2-parent family with two children and eligibility income of 32000 would qualify for 100 percent tax forgiveness. Pa schedule sp special tax forgiveness credit part a. Forgiveness Credit on Line 21 of the.

Fill in the oval. Quick steps to complete and design Schedule sp online. Provide all the information for each dependent child.

Refer to Chapter 20 of the PA PIT Guide for. Because eligibility income is different from taxable income taxpayers must. PA-40 Personal Income Tax Return for any taxpayers claiming the Tax.

In the If Dependent of Another Person section enter data as needed. Fill in the Unmarried oval on Line 19a of your PA-40. An originally filed PA-40 Personal Income Tax Return for.

Form PA-40 SP requires you to list multiple. Go to screen 53. To claim tax forgiveness the claimant or claimants must complete and submit PA-40 Schedule SP with the PA-40 Individual Income Tax return.

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

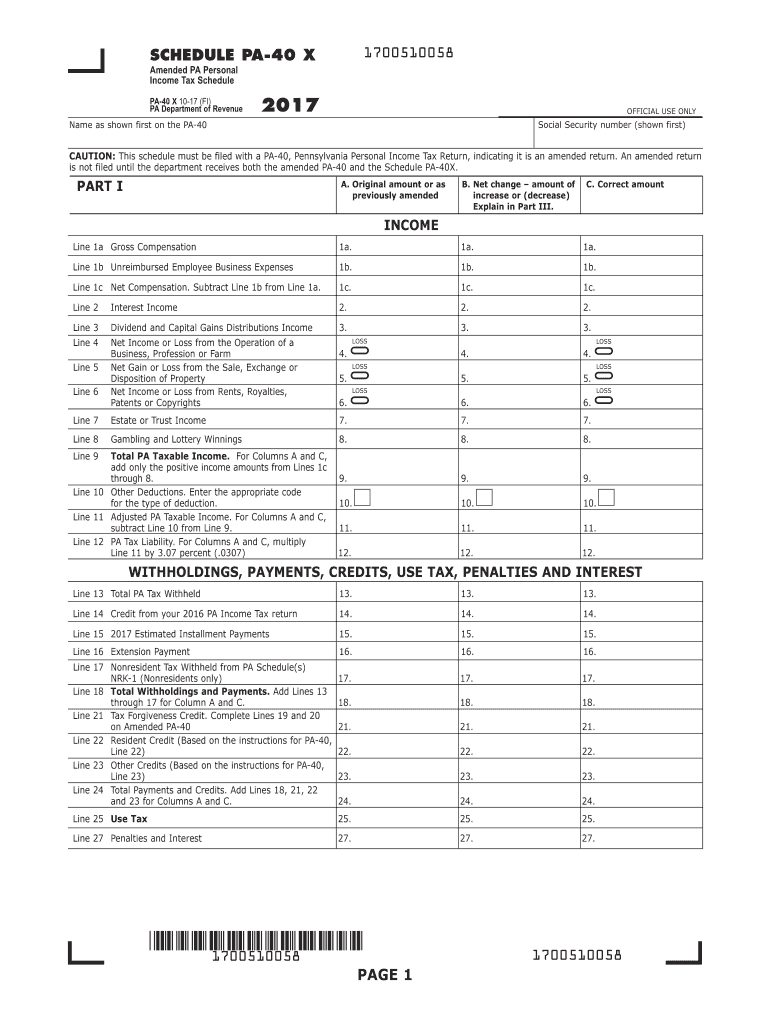

Pa Schedule Pa 40x 2017 Fill Out Tax Template Online Us Legal Forms

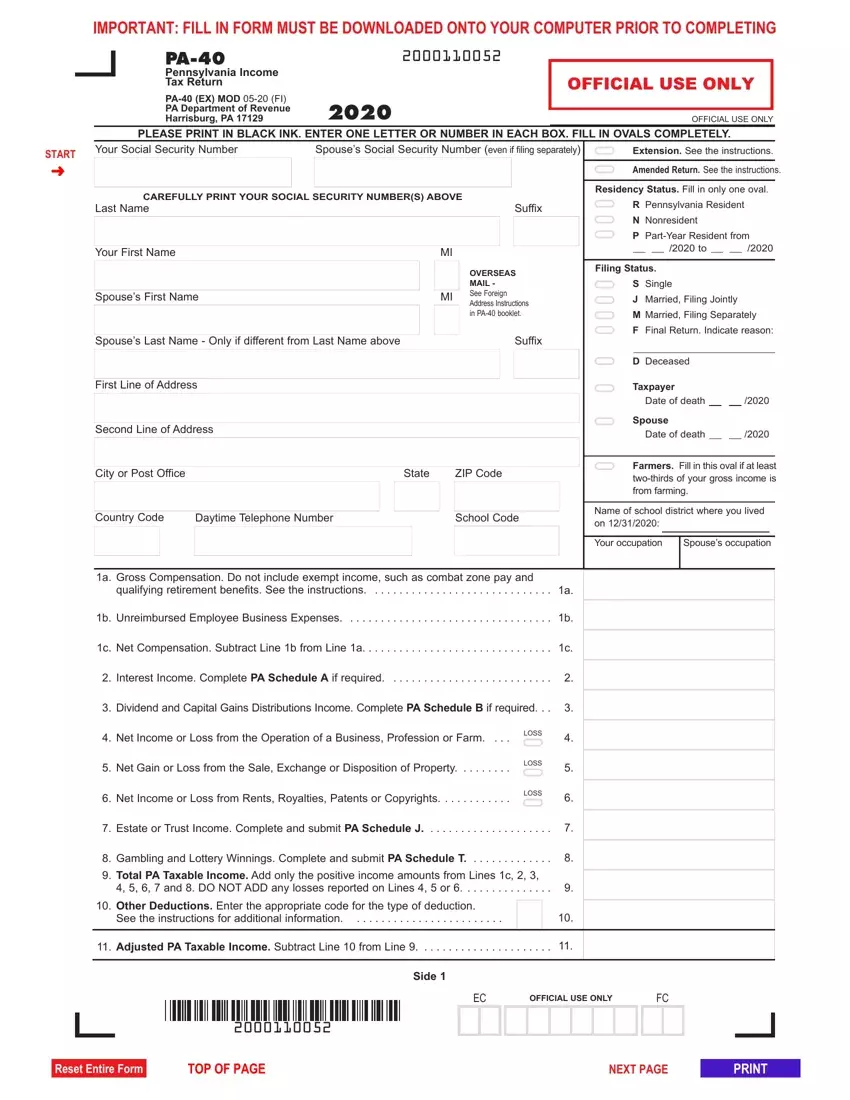

Free Form Pa 40 Pennsylvania Income Tax Return Free Legal Forms Laws Com

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Form Pa 40 2011 Pennsylvania Income Tax Return Pa 40

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Pa 40 Tax Form Fill Out Printable Pdf Forms Online

Pa Dor Pa 40 Sp 2017 Fill Out Tax Template Online Us Legal Forms

Form Pa 40sp Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp

Pa Schedule Ue 2021 Fill Online Printable Fillable Blank Pdffiller

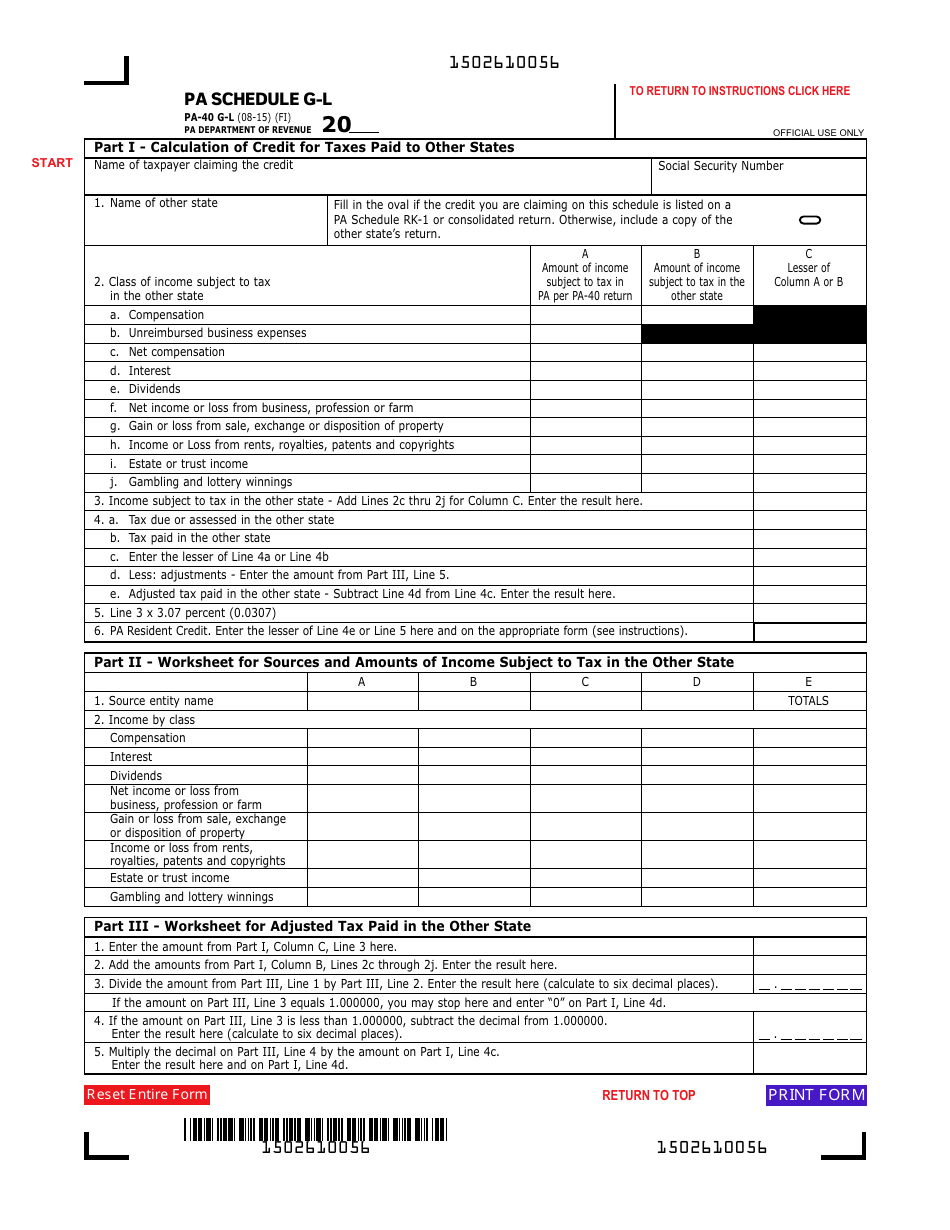

Form Pa 40 Schedule G L Download Fillable Pdf Or Fill Online Resident Credit For Taxes Paid Pennsylvania Templateroller

Pa Schedule Sp Form Fill Out And Sign Printable Pdf Template Signnow